About FL SAFE

FL SAFE, Florida Surplus Asset Fund Trust, was formed in December 2007 and is a local government investment pool developed by Florida local governments for Florida local governments. FL SAFE has no association with the State of Florida. FL SAFE’s sole purpose is to serve government entities in Florida to meet their daily cash management needs with an emphasis on safety, liquidity, transparency and competitive yields.

We encourage you to consider the benefits of a FL SAFE account. Here are some of the valued services we offer:

- Website Access: FL SAFE has developed a comprehensive web site to meet the growing needs of Florida governments. Participants can securely enter transaction requests, as well as access account balances, statements and transaction history. The FL SAFE website is secured with a VeriSign 128 bit Extended Validation SSL certificate.

- Multiple Accounts: To help with the funding of government projects and services, we have the ability to setup multiple accounts for a single entity (construction projects, reserve funds, or other special projects). Please let us know how we can make your job easier.

- Tax Revenue: Distributions earn interest immediately on your revenue distributions by setting up a FL SAFE account to automatically receive the monthly revenue distributions from the state or your county for FEFP payments, local option sales tax revenue or property tax receipts.

- Free Third Party Wire/ACH Services: We also offer free third party wire or ACH services for recurring monthly obligations such as health insurance premiums or employee retirement fund payments.

SPECIALIZED RESEARCH

We regularly post the latest in economic and financial research reports and provide links to topics of interest to FL SAFE Participants.

Board of Trustees

The Board of Trustees consists of government representatives charged with general oversight of FL SAFE as detailed in the Indenture of Trust. The Board members will serve three year staggered terms and will not receive any monetary compensation for their service. The Board of Trustees include:

Linda Senne, CPA, CGFM, CGMA

Madame Chair

Finance Director

City of Venice

FGFOA – Southwest Chapter

Term Ending: January 1, 2027

View Biography

Jerry Boop, CPA, CGFO

Vice Chair

Finance Director

City of Oviedo

FGFOA – Central Florida Chapter

Term Ending: January 1, 2025

View Biography

William Spivey

Secretary

Board Member

Seminole County Port Authority

FGFOA – Central Florida Chapter

Term Ending: January 1, 2026

View Biography

Christine Cajuste, CPA, MBA

Board Member

Finance Director

City of Tamarac, Florida

FGFOA – South Florida Chapter

Term Ending: January 1, 2027

View Biography

Heather Abrams

Treasurer

Debt & Treasury Manager

City of Cape Coral, Florida

Term Ending: January 1, 2027

View Biography

Advisory Council

The Advisory Council members are recommended by the FL SAFE Administrator and Investment Advisor, and the Advisory Council is confirmed by the Board. They serve at will, and as a Participant, provide additional insight and advice of FL SAFE Investment programs and services.

Dan Carpenter

Finance Director

City of Indian Rocks Beach

Jordan Steffens

Senior Finance Director

Okaloosa County Clerk & Comptroller

Jerry Gray, CPA

Finance Director

City of Maitland

Chris Reeder

Finance Director

City of Auburndale

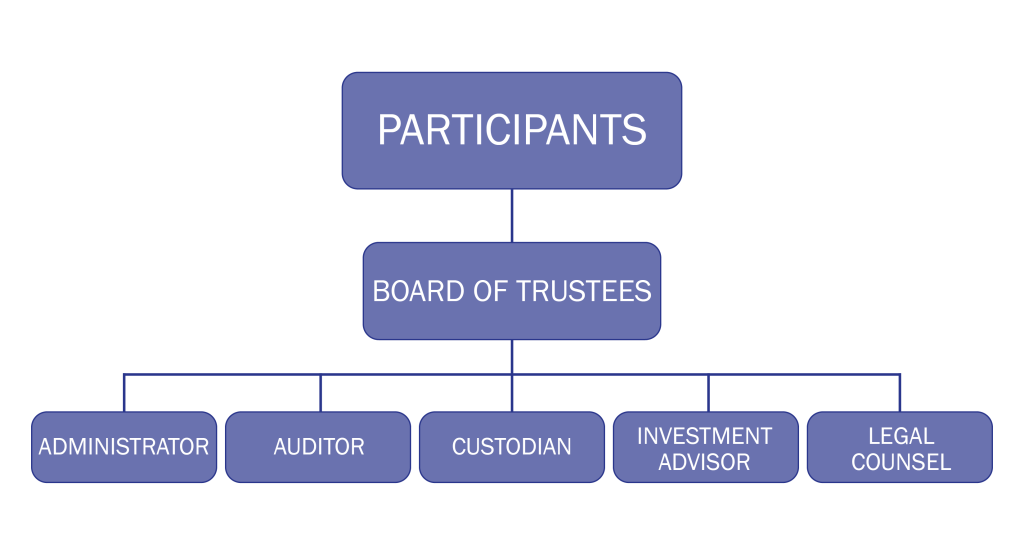

Organizational Chart

PARTICIPANTS

FL SAFE was developed by Florida governmental entities for the benefit of participating government entities. As an authorized investment under Florida Statutes 163.01 and 218.415, FL SAFE is open to any government entity including cities, counties, towns, school districts, public utilities, special districts, port and waterway authorities, transit districts, colleges and universities, local government property and casualty and health insurance pools. All of the services developed for FL SAFE will be focused on safety, liquidity, transparency and competitive yields to benefit and protect Participant interests.

BOARD OF TRUSTEES

The Board of Trustees is primarily comprised of government officials that have investment responsibility for their government entity.

INVESTMENT ADVISOR, DISTRIBUTOR & OPERATIONAL MANAGER

The Investment Advisor is PMA Asset Management, LLC, an SEC registered investment advisor. The Operational Manager is PMA Financial Network, LLC. The Distributor is PMA Securities, LLC. PMA Asset Management, LLC., PMA Financial Network, LLC. and PMA Securities, LLC., which operate under common ownership and are referred to collectively as “PMA”.

PMA is a national financial services provider that seeks to provide long-term financial success for its clients. For a quarter-century, government entities have turned to PMA as a trusted partner and integral component of their long-term financial success. With billions of dollars invested annually, PMA provides over 2,400 clients with a diverse lineup of customized financial solutions through a team of experienced professionals and some of the most innovative technology available. Additional information about PMA is available at www.pmanetwork.com.

ADMINISTRATOR

Florida Management and Administrative Services, LLC (“FMAS”) is a full service management and administrative services firm based in Orlando. Its President, Jeff Larson, was involved in the establishment of FL SAFE in 2007-2008, and was retained in May 2011 by the FL SAFE Board to serve as Administrator.

CUSTODIAN AND BANK

The Custodian is BMO Harris Bank N.A., a diversified financial institution (www.harrisbank.com).

AUDITOR

The Auditor is CliftonLarsonAllen LLP (www.cliftonlarsonallen.com/).

LEGAL COUNSEL

The Legal Counsel is Akerman LLP, a law firm with six offices in Florida. They have specific expertise in a number of areas including public finance and investments (www.akerman.com).

Management

ADMINISTRATIVE SERVICES

Florida Management and Administrative Services, LLC provides administrative service to FL SAFE Participants. These duties include:

- Arranging and managing the annual audit of FL SAFE

- Organizing quarterly board meetings per Florida Statutes

- Securing surety and other bonds, and insurance necessary to protect FL SAFE

- Developing and implementing FL SAFE sales and marketing plan

- Providing Participant and potential Participant seminars

- Maintaining Board elections per indenture

- Assist with FIIP and Term Series administrative and oversight

INVESTMENT ADVISORY, OPERATIONAL AND DISTRIBUTOR SERVICES

PMA Asset Management, LLC., PMA Financial Network, LLC. and PMA Securities, LLC. serve as the Investment Advisor, Operational Manger and Distributor to FL SAFE, respectively. PMA Asset Management, LLC., PMA Financial Network, LLC. and PMA Securities, LLC. operate under common ownership and are referred to collectively as “PMA”. Duties include:

Investment Advisor – Portfolio Management Duties – PMA Asset Management, LLC.

- Portfolio allocation and criteria development

- Daily cash flow management

- Security transaction selection/execution

- Monitoring fixed income markets

- Prepare and monitor approved list of securities-Trust Investment Policy

- Monitor and recommend updates to FL SAFE’s Investment Policy

- Quarterly evaluation of the investment performance of FL SAFE to Board

- Maintain and develop policies and procedures for Investment Advisor functions

- Support Trust Sales & Marketing Plan in cooperation with Administrator

- Manage annual rating agency review, provide rating agency required reports

- Assist with Participant and prospect investment and educational seminars

- Provide monthly economic update to Administrator for Trust newsletter and website

- Maintain accurate records concerning its services hereunder as required under the securities laws

- Other duties as directed by Board and standard for Industry as Investment Advisor

Operational Manager – Accounting and Operations Duties – PMA Financial Network, LLC.

- Management of PMA operations staff working on FL SAFE matters

- Maintain and update fund accounting system

- Maintenance of accounting software

- Review and approve daily fund accounting report

- Prepare unaudited quarterly account statements for FL SAFE Board’s review and approval

- Determine and allocate income of FL SAFE, including the monthly budgeted expenses of the Trust

- Maintain separate accounts for each Participant

- Record individual transactions and totals of all investments

- Serve as registrar for FL SAFE

- Arrange for the redemption of shares by Participants

- Manage FL SAFE’s expenses and budgeting in cooperation with Board and Administrator

- Assist in preparation of audit, as needed, supplying information, addressing auditor’s questions

- Maintain Participant recordkeeping

- Open and close Participant accounts in cooperation with administrator

- Participant transaction processing

- Post monthly statements of Participant

- Provide written confirmation of investment and withdrawal of funds to Participants

- Support with participant Q&A and Participant customer service in cooperation with Administrator

- Other duties as directed by Board and standard for industry as Operational Manger

- Website management duties: Marketing and transactional websites (FMAS will have direct access) and FundLink website for Board communications (FMAS and Board Trustees will have direct access)

- Daily participant calculation balance

- Daily information updates

Business continuity, including website back-up and disaster recovery plan - Manage and arrange website

- Other duties as directed by Board and standard for industry for LGIP Website Manager

Distribution Duties – PMA Securities, LLC.

- Management and compliance of PMA distribution staff marketing for FL SAFE

- Market FL SAFE and its programs and services to eligible Participants

Custodian

BMO Harris Bank N.A.

Hank Gay

Vice President

111 W. Monroe St.

Chicago, IL 60603

312-461-2439

¹ As of of 10/19/2012

Auditor

The auditor for FL SAFE is Clifton Larson Allen LLP. (CLA) the successor firm from the merger of Clifton Gunderson and Larson Allen,(http://claconnect.com), one of the nation’s largest certified public accounting and consulting firms, provides a wide range of assurance, accounting, tax, and consulting services to clients in a variety of industries. Clifton Larson Allen has a staff of approximately 4,000 professionals serving more than 150,000 clients from 90 offices across the country.¹

Clifton Larson Allen LLP

Chris Knopik

Principal

220 South Sixth Street, Suite 300

Minneapolis, MN 55402

612-397-3266

¹ As of 10/5/2015

Legal Counsel

With more than 600 attorneys and government affairs officials, Akerman LLP (www.akerman.com) is distinguished by its comprehensive corporate, public finance, real estate, construction, government relations, labor and employment, litigation, and intellectual property practices. Providing services to local, regional, national and international clients, their team of legal advisors and consultants represents private and public companies, government entities, educational institutions and high net-worth individuals in over 40 different practice areas.

Akerman LLP maintains 20 offices, including in the nation’s principal financial and political centers – New York, Washington, D.C. and Los Angeles – as well as multiple office locations throughout Florida, including: Orlando, Jacksonville, Tampa, Tallahassee, West Palm Beach, Fort Lauderdale and Miami.

Akerman LLP

David Rosen

Partner

420 South Orange Avenue, Suite 1200

Orlando, Florida 32801

407-419-8414